Millennials may be famous for not wanting to own anything, but that adage doesn’t seem as true when it comes to homeownership.

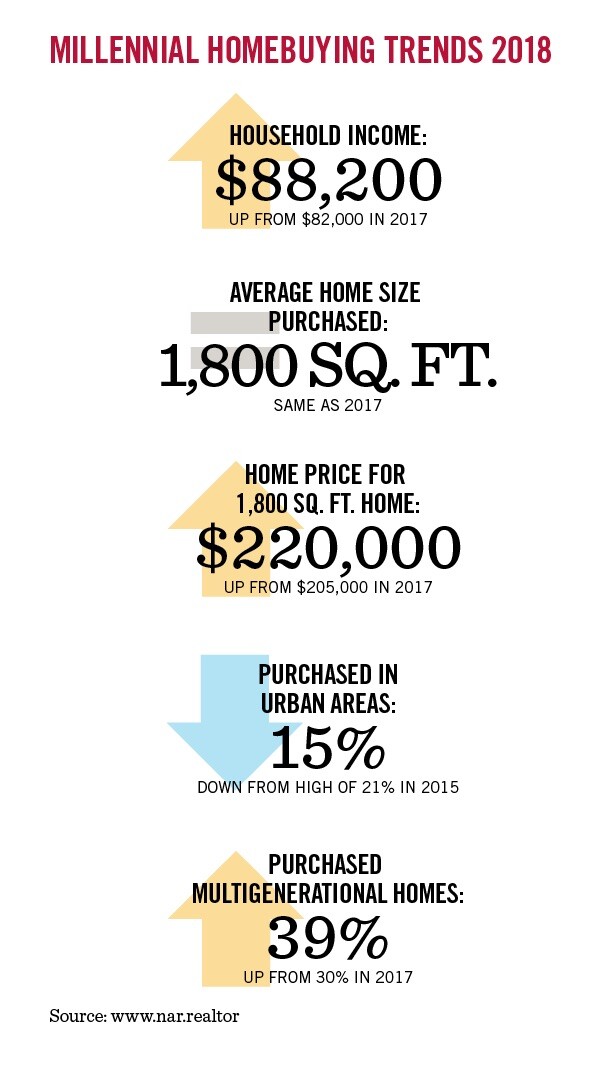

In past generations, the younger set has historically not been a strong homebuyer segment. However, according to the National Association of REALTORS® 2018 Home Buyer and Seller Generational Trends study, 36% of home purchases were made by millennials. They are the largest generation buying homes, with their numbers growing steadily over the past five years. And, 66% of those who purchased were first-time homebuyers—which means about a third had purchased at least one home prior to the survey period.1

A clear influencer of millennial homeownership is family. This group is highly interested in keeping their family close and caring for aging parents or grandparents.

With the housing market heating up in many parts of the country—fueled by higher prices, limited inventory and rising interest rates—many millennials are questioning if they should make the move to buy a home now or wait for a few years. The answer may be in recently-published research from the Journal of the Center for Real Estate Studies. This study found that homeownership does indeed make a significant impact on social outcomes including educational achievement, civic participation, and improved health.

Additional benefits of homeownership: greater privacy, high probability of your investment increasing in value, predictable costs (fixed-rate mortgage), tax deductions on interest and property taxes, and closer community ties.

Preparing for Homeownership

Buying a home is a big step—the investment affects your day-to-day actions and your overall financial situation. Before contacting a real estate agent, consider these tips:

1. Create a realistic wish list

Select five key requirements for a home and rank them by importance.

2. Set a budget

Crunch the actual numbers, instead of just estimating, to help you from getting in over your head.

3. Don’t forget the down payment and closing costs

These costs can quickly break your budget if left out of your initial calculations.

Bottom line: if you’re interested in purchasing your first home, a meeting with your financial advisor or an experienced mortgage loan officer is in order. These professionals can assess your financial situation and find out what the best strategy is to achieve your dreams.

1Survey participants purchased a home between July 2016 and June 2017.